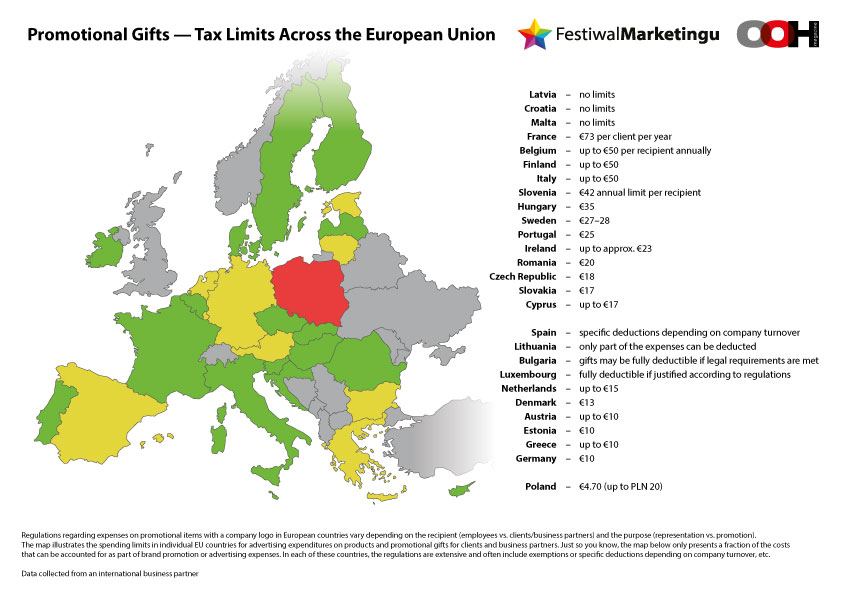

Promotional Gifts — Tax Limits Across the European Union

Promotional gifts have been an important element of marketing strategies for many companies for years. However, their use is regulated to varying degrees by the tax laws of different European countries. Below, we present an overview of the value limits for promotional gifts in EU countries, showing how different the approaches to this topic can be.

Regulations concerning expenses on promotional gifts with a company logo in European countries differ depending on the recipient (employees vs. customers/business partners) and the purpose (representation vs. promotion).

On the map, we present the limits in individual EU countries regarding advertising expenditures on products and gifts for customers and business partners. It is important to note that the map below only shows a fraction of the costs that can be accounted for as part of brand promotion or advertising expenses. In each of these countries, the regulations are extensive and often include exemptions or specific deductions depending on company turnover, etc.

Countries Without Limits

In some countries, there are no statutory limits on the value of promotional gifts:

Latvia – no limits

There are no statutory limits on the value of promotional gifts. Expenditures on promotional gifts are recognized as tax-deductible expenses, provided they are justified by promotional purposes and properly documented. The value of gifts should be reasonable and cannot be treated as a form of remuneration.

Croatia – no limits

There are no statutory limits on the value of promotional gifts. Promotional gifts or those aimed at building business relationships are generally recognized as tax-deductible. However, frequent or expensive gifts without a clear business justification may be questioned by tax authorities.

Malta – no limits

Promotional or business relationship-building gifts are generally considered tax-deductible expenses, provided they are justified by promotional objectives and properly documented. Excessive or frequent gifts may raise doubts about their business purpose.

Denmark – no limits

There are rules regarding tax deductions for promotional gifts given to clients. These expenses can be fully deductible if certain conditions are met.

In such cases, the only restrictions may be general rules on tax-deductible costs or local industry regulations.

Countries with Higher Limits (Over €40)

Some countries allow for relatively high expenditures:

France – €73 per client/gift annually

Promotional gift expenses are tax-deductible, provided the value of a single gift does not exceed €73. If the value exceeds this threshold, the company cannot deduct VAT on the expense.

Belgium – up to €50 per recipient annually

Promotional gifts are fully deductible if their net value does not exceed €50 per recipient annually. If the value exceeds this amount, only 50% of the cost can be deducted.

Finland – up to €50

General tax deduction rules may also cover such expenses if specific conditions are met.

Italy – up to €50

Promotional gift expenses are tax-deductible if the value does not exceed €50. If the threshold is exceeded, VAT cannot be deducted.

Slovenia – €42 per recipient annually

Promotional gift expenses are deductible up to €42 per recipient per year. Exceeding this amount disqualifies VAT deduction.

Medium Limits (€20–40)

Another group of countries applies moderate limits that restrict gift value but still allow for relatively flexible marketing:

Hungary – €35

If the total annual value of gifts per recipient exceeds €35 (excluding VAT), VAT deduction is not allowed. The value of a single gift may not exceed €15 (excluding VAT).

Sweden – €27–28

Promotional gifts are deductible up to 300 SEK (approx. €28) per recipient annually. Exceeding this amount excludes VAT deduction.

Portugal – €25

General tax deduction rules apply to promotional gifts, provided the €25 threshold is not exceeded.

Ireland – approx. €20

- Gifts up to €20 (excluding VAT): No VAT applies if the gift is not part of a series to the same recipient.

- Gifts above €20: VAT must be charged on the full value, unless the item qualifies as a “promotional good.”

Romania – €20

Single gift value up to 100 RON (approx. €20).

Lower Limits (€10–20)

In many countries, lower thresholds apply:

Czech Republic – €18

Promotional gifts up to 500 CZK (approx. €18) are fully VAT-deductible, provided they are branded and not subject to excise duty.

Slovakia – €17

A single promotional gift cannot exceed €17 if VAT is to be deducted.

Cyprus – €17

Promotional gifts below €17 are fully VAT-deductible.

Netherlands – €15

- Annual limit per recipient: €227 (excluding VAT).

- Single gift over €15: triggers a VAT charge by the company.

Austria – €10

The value of a single promotional gift cannot exceed €10 to allow VAT deduction.

Estonia – €10

An increase of the exemption limit from €10 to €21 is planned.

Greece – €10

Germany – €10

The value of a single promotional gift cannot exceed €10 for VAT deduction.

Lowest Limits

The strictest rules apply in Poland, where the maximum value of a promotional gift is PLN 20 (approx. €4.70).

Special Rules

In some countries, regulations do not set fixed monetary limits, but other tax deduction rules apply:

Spain – deduction depends on the company’s turnover

VAT deductibility depends on turnover. For companies with an annual turnover below €2 million, gifts up to €200 annually can be deductible if they are promotional samples or low-value gifts. Otherwise, VAT is not deductible.

Lithuania – only part of the expenditure is deductible

From 17 February 2025, the scope of promotional gifts recognized as deductible representation expenses has been expanded. Expenditures must serve promotional purposes and be properly documented.

Bulgaria – full deductions if legal requirements are met

Promotional gifts may be fully deductible if they are related to business activity and meet specific legal requirements. These expenses are treated as representation costs and may be subject to additional taxes (e.g., 10% representation tax).

Luxembourg – full deductions if justified

VAT on promotional gifts may be deducted if the items are used for business purposes. There are no specific monetary limits, but valid VAT invoices and compliance with general tax deduction rules are required.

Summary

Europe has no uniform approach to promotional gift expenditures. For companies operating in several countries simultaneously, this means the need to closely monitor local regulations and adjust the value of promotional gifts to comply with applicable tax rules.

All data has been collected from OOH magazine’s foreign business partners.